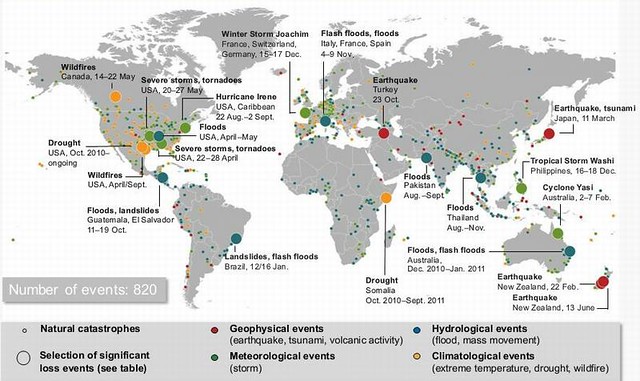

全球最大再保險公司之一的慕尼黑再保公司(Munich Re)指出,人口稠密區毀滅性的地震與氣候災害,使2011年成為保險業界因自然災害損失最慘重的一年。

全球最大再保險公司之一的慕尼黑再保公司(Munich Re)指出,人口稠密區毀滅性的地震與氣候災害,使2011年成為保險業界因自然災害損失最慘重的一年。

2011年高達3800億美金的經濟損失,比次高的2005年的2200億美金高出達三分之二,其中亞洲與北美的保險損失為最大。

光是2011年3月在日本以及2月在紐西蘭的地震損失幾乎就佔了上述損失的三分之二。保險損失達1050億美金,超過2005年的1010億美金。

日本的地震與海嘯是2011年最致命的自然災害,共造成15,840人死亡,相較之下,紐西蘭的地震雖僅造成幾個人死亡,但保險損失也是極高。

「幸運的是,像去年這樣連續的自然災害是很少見的,」慕尼黑再保公司負責全球再保業務的董事會成員Torsten Jeworrek表示,「我們在某些地方可能得要面對千年一次的災難,但我們已做好面對這類極端狀況的準備。」

所記錄的自然災害中有90%與天候有關,近三分之二的經濟損失和大約一半的保險損失則源自於大地震這類地質事件,而非天候這類造成災害的主因。

慕尼黑再保公司氣象中心主任 Ernst Rauch 說,「至少部分頻率的增加以及與天候相關災害的增加是氣候變遷所造成。」

由過去三十年來的平均值來看,地質事件只造成了不到10%的保險損失,而2011年區域損失的分佈也很不尋常,大約70%的經濟損失發生在亞洲。

2011年大約有27,000人死於自然災害,這還不包括非洲之角數十年來最大旱災所造成的死亡,這是2011年最慘重的人道災難。內戰與政局不穩使得援助很難有效送到受害者手中。

2011年最具破壞性的災難事件是3月11日發生在日本東北地區的地震,這場規模9.0的太平洋地震發生在仙台港東邊130公里,東京北方370公里的地方,是日本有紀錄以來最強的一個。

2011年最具破壞性的災難事件是3月11日發生在日本東北地區的地震,這場規模9.0的太平洋地震發生在仙台港東邊130公里,東京北方370公里的地方,是日本有紀錄以來最強的一個。

儘管有高保護性的堤防以及預警系統,仍有16000人受害,但若沒有那些設施,死亡人數將會更高。

慕尼黑再保公司表示,即使不考慮核能事故,地震與海嘯造成的損失也達2100億美金,是所有損失金額最高的。

在美國,發生在日本的海嘯造成了奧勒岡州與加州沿岸港口與船隻損失達1億美金。

2011稍早的時候,紐西蘭基督城在2月22日發生了芮氏規模6.3的地震,6個月前基督城也發生了規模7.1的地震。震波受到一座死火山的反射而增強,所以造成的破壞比一般這種規模地震的破壞要大。

這個淺層地震的震央距離市中心只有幾公里,造成了巨大的損失。許多老舊建築物倒塌,而新的建築雖然有較高的建築標準,也多有受損。部分住宅區將無法重建。所造成的經濟損失約160億美金,其中有保險的部分約有130億美金。

慕尼黑再保公司風險研究組主任Peter Hoppe教授表示,「即使在發生這些事情後很難令人相信,但是地震的頻率並沒有增加。」「然而,這些嚴重的地震適時的提醒我們,在建造城鎮時應該更加小心評估這類風險,特別是牽涉到核電廠這類特定建築物的時候。」

2011年眾多與天候相關的災害事件中,以泰國大水事件最突出。這場大水來自春季自秋季間的大量降雨。由於泰國首都曼谷所處的中央平原區低於海平面,在每年5至11月的雨季中特別容易受到大水威脅。根據泰國有關單局表示,2011年的水患是50年來最嚴重的一次。

2011年眾多與天候相關的災害事件中,以泰國大水事件最突出。這場大水來自春季自秋季間的大量降雨。由於泰國首都曼谷所處的中央平原區低於海平面,在每年5至11月的雨季中特別容易受到大水威脅。根據泰國有關單局表示,2011年的水患是50年來最嚴重的一次。

許多電子關鍵組件製造商受到影響,導致生產受到延誤與干擾,影響全球25%的電腦硬碟零組件供應。經濟損失達數百億美金,這場大水是泰國有史以來損失金額最慘重的天然災害。

根據總部設在紐約市的保險資訊研究所統計,在美國,2011年的保險損失總額達359億美金,超過2000年到2010年間損失平均值的238億美金。

在美國中西部與南部各州龍捲風的破壞力特別強。幾次包含數個龍捲風的系列風暴造成了460億美金的損失,其中250億美金有保險。保險損失的金額超過2010年紀錄的兩倍以上。

在美國中西部與南部各州龍捲風的破壞力特別強。幾次包含數個龍捲風的系列風暴造成了460億美金的損失,其中250億美金有保險。保險損失的金額超過2010年紀錄的兩倍以上。

慕尼黑再保公司高層在一場網路研討會中表示,反聖嬰現象可以大幅度解釋這一系列嚴重的天災。這種熱帶太平洋東部的自然變動,也使美國西北方的冷空氣更常入侵中部各州,並且在南方與溼熱的空氣交會。這樣的情況下,劇烈的天候事件會比平常更多。

根據慕尼黑在保的資料顯示,自1980年以來,暴風雨造成的平均損失增加了5倍,在2011年達到258億美金。

由於長期乾旱,徳州在2011年的火災紀錄是最嚴重的。春天的時候,12場大火燒燬徳州西部超過300萬英畝的土地,摧毀了200個家庭與企業,保險損失達5000萬美金。

慕尼黑再保公司統計,9月時的一場大火燒燬聖安東尼奧超過1600個家庭,保險損失達5.3億美金。

保險研究所所長Robert Hartwig在4日的網路研討會中對記者表示,人口增長移入高收入與高地價區的現象,「不成比例的」增加了美國易發生災難區的人口。他表示,「波動性以及花費將會在未來更為增加」。

Devastating earthquakes in densely populated areas and a large number of weather-related disasters made 2011 the costliest year ever for natural catastrophe losses in the insurance industry, according to executives at Munich Re, one of the world's largest reinsurance companies.

At about US$380 billion, global economic losses were nearly two-thirds higher than in 2005, the previous record year, when losses amounted to US$220 billion. Asia and North America racked up the most insured losses.

Earthquakes in Japan in March and New Zealand in February alone caused almost two-thirds of these losses. Insured losses of US$105 billion exceeded the 2005 record of US$101 billion.

The Japan earthquake and tsunami caused 15,840 fatalities, the deadliest natural disaster in 2011. While the earthquakes in New Zealand caused high losses for insurers, there were few fatalities.

"Thankfully, a sequence of severe natural catastrophes like last year's is a very rare occurrence," said Torsten Jeworrek, Munich Re Board member responsible for global reinsurance business. "We had to contend with events with return periods of once every 1,000 years or even higher at the locations concerned. But we are prepared for such extreme situations."

Ninety percent of the recorded natural catastrophes were weather-related. Yet nearly two-thirds of economic losses and about half the insured losses stemmed from geophysical events such as the large earthquakes instead of the the weather-related events that are usually the dominant loss drivers.

"At least part of this increased frequency and number of weather-related disasters is driven by climate change," said Ernst Rauch, who heads Munich Re's Corporate Climate Center.

On average over the last three decades, geophysical events accounted for just under 10 percent of insured losses. The distribution of regional losses in 2011 was also unusual. Around 70 percent of economic losses in 2011 occurred in Asia.

Approximately 27,000 people died as a result of natural catastrophes in 2011, not including those who died as a result of the famine following the worst drought in decades in the Horn of Africa, which was the greatest humanitarian catastrophe of the year. Civil war and political instability made it very difficult to bring effective aid to the victims.

The most destructive loss event of the year was the March 11 earthquake in Tohoku, Japan, when a Pacific Ocean seaquake with a magnitude of 9.0 occurred 130 kilometers east of the port of Sendai and 370 km north of Tokyo. It was the strongest quake ever recorded in Japan.

Some 16,000 people were killed in spite of high protective dykes and an early-warning system, without which the death toll would have been much higher.

Even without considering the consequences of the nuclear accident, the economic losses caused by the quake and the tsunami came to US$210 billion, the costliest natural catastrophe of all time, said Munich Re.

In the United States, the Japanese tsunami caused $100 million in damages to ports and boats along the Oregon and California coasts.

Earlier in the year, on February 22, there was an earthquake of 6.3 magnitude in Christchurch, New Zealand, following an earthquake of 7.1 magnitude that hit Christchurch six months earlier. The seismic waves were amplified due to reflection off an extinct volcano, so that far greater destruction was caused than would have normally been expected with an earthquake of this magnitude.

The epicentre was at a shallow depth just a few kilometers from the city center. The losses were enormous. Numerous old buildings collapsed, and many new buildings were damaged despite the very high building standards. Some residential areas will not be rebuilt. Economic losses came to around US$16 billion, of which approximately US$13 billion was insured.

"Even if it seems hard to believe given recent events, the probability of earthquakes has not increased," said Professor Peter Hoppe, head of Munich Re's Geo Risks Research unit. "However, these severe earthquakes are timely reminders that the decisions on where to build towns need careful and serious consideration of these risks, especially where certain buildings are concerned, above all nuclear power plants."

Bangkok bus breaks down on a flooded street, October 25, 2011. (Photo by Pailin_C)

The floods in Thailand stand out among the many weather-related catastrophes of 2011. They were triggered by extreme rainfall, which started in spring and peaked in the autumn. Due to its low elevation above sea level, the plain of central Thailand, where the capital Bangkok is situated, is prone to flooding throughout the rainy season from May to October. According to Thai authorities, this year's floods were the worst for around 50 years.

Many electronic key component manufacturers were affected, leading to production delays and disruptions that impacted some 25 percent of the world's supply of components for computer hard drives. With economic losses amounting to tens of billions of dollars, the floods were by far the costliest natural catastrophe in Thailand's history.

In the United States, 2011 insured losses totaled $35.9 billion - above the 2000 to 2010 average loss of $23.8 billion (in 2011 dollars), according to the Insurance Information Institute, based in New York City.

The tornado season was especially violent in the Midwest and southern states. Several series of storms with numerous tornadoes caused economic losses totalling some US$46 billion, of which US$25 billion was insured. Insured losses were twice as high as in the previous record year of 2010.

The series of severe weather events can largely be explained by the La Nina climate phenomenon, said Munich Re executives on the webinar. As part of this natural climate oscillation in the eastern tropical Pacific Ocean, weather fronts with cool air from the northwest more frequently move over the central states and meet humid warm air in the south. Under such conditions, extreme weather events are more probable than in normal years.

Average thunderstorm losses have increased fivefold since 1980, according to Munich Re data, totalling $25.8 billion in 2011.

It was the worst wildfire year on record in Texas due to persistent drought. In the spring, more than three million acres burned in west Texas from 12 fires, destroying more than 200 homes and businesses, with an insured loss of $50 million.

In September, a major wildfire burned over 1,600 homes near San Antonio, with an insured loss of $530 million, calculates Munich Re.

Robert Hartwig, president of the Insurance Information Institute, told reporters in a webinar today that the growing demographic shift into areas of high wealth and property value, is "disproportionately" increasing the population of the disaster-prone areas of the United States.

Hartwig said, "We may be seeing increased volatility and a more costly future."